Love Who You Lead.

Love Why You Lead.

Love Where It Leads.

Love Who You Lead.

Love Why You Lead.

Love Where It Leads.

6P Life Leadership Assessment

Most leaders face roadblocks on the leadership journey, but the good news is you can overcome them. Find out where you’re currently strong and weak — and what to do next — with the 6P Life Leadership Self-Assessment.

Hey Friends!

I’m Eric…also known as “Dr. Eric J. Roman, DDS, FAGD.” But that’s a mouthful, so please, call me Eric.

Dental group practices and DSOs are my thing, but not necessarily in the same way as everyone else. I’m spreading love throughout group dentistry. I believe that our best future starts with healthy teams, healthy dentists, and healthy leaders. And I know how to get there.

As an operator, I founded and exited my own groups…generating hundreds of millions in dentistry and [sadly] cycling through thousands of employees along the way. It was freaking hard! Now, as a coach, I’ve had the opportunity to serve billions a year of annual DSO revenue. And I’m confident that I can give you better dentist performance, amazing clinical leadership systems, and managers that drive sustainable results.

But the journey to get here almost cost me the thing that matters most.

Join Me on a Transformative Journey

A lot of my business experience has been in the world of dentistry, but at my very heart I’m just an entrepreneur. If you’re an entrepreneur in the dental industry, join me in the vibrant community at the Dentist, Let’s explore together how to evolve your practice from being a single-practice dentist, potentially vulnerable to market fluctuations, to becoming a robust, diversified dental enterprise. Step into this exciting world of dental entrepreneurship and discover a world of opportunities you never thought possible. Let’s learn, grow, and succeed, together.

Upcoming Events

Founders Retreat Park City, Utah

Nov 9-10, 2023

1 Life Retreat

Salt Lake City, Utah

Feb 9 - 10, 2024

Dykema DSO Conference 2023 Atlanta, GA

July 19-21, 2023

Work With Me

Dentist Playbook

Whether you are an associate or you own your practice, this is designed to help you unlock your full potential as a dentist. Clinical confidence, control over your financial future, and work-life harmony. Our program will make you the MASTER of your time, your clinical outcomes, and your income… EVEN if you work in someone else's practice.

Dental Associate Growth

Clinical Directors! The first and only program for predictable clinical leadership. This is the recipe and the rhythm your company needs if you've committed to growth through dental associates proven strategies to find the right dentists and keep them. Scalable systems to optimize performance without micromanaging. Real results - not just theory. Step-by-step implementation with support.

joyFULL™ Manager

Management…When did it become a dirty, four-letter word? In healthcare, no matter how large your business, everything rises and falls and good. This program gives managers, operators, regionals AND owners the fundamentals for scalable practice performance.

DNTL Collectiv

IYKYK. Invitation only gathering for industry insiders. Unlike anything else.

Speaking

Audiences love Eric’s energy, stories, and real-world approach to business and life. He’s done everything from event intros to keynote addresses to all-day workshops.

3 Ways I Can Help You

I’m Giving Group Dentistry Healthier And More Productive Associates, Clinical Directors, And Teams.

NEWSLETTER

Every week I send out valuable tips that build healthier leaders, healthier dentists, and healthier teams. Peak Performance starts with true health, at work AND at home.

Dentist Playbook

Allow me to coach your dentists FOR YOU, with foundational skills that drive engagement and performance. Your dentists will build Quarterly performance...

Clinical Director Program

Whether it’s you, someone else, or a team doing the work…Together we will BUILD and INSTALL the systems you’ve been dreaming of for your dentists, including standards...

Recent Articles

Fear-Setting and the Cost of Inaction

Let’s talk about the elephant in the room, shall we? FEAR. Yup, I said it. And

Pick Your “P” and Run With It

Just when we thought we had everything figured out...the world turned upside dow

Why It’s Time for The Generation of We

Just when we thought we had everything figured out...the world turned upside dow

Put Me On Your Stage Or Podcast

When I’m on stage, I’m frequently an audience favorite.

Fundamentals of Practice Performance

Actionable Keys to Healthy Cultures

Why Associates Leave and What to Do About it…

Systems for High-Performing Dentists/Dental Groups

Workshop: Half-Day/Full-Day Team Health Workshop [Work Life Balance]

Workshop: Half-Day Associate Dentist Performance Workshop

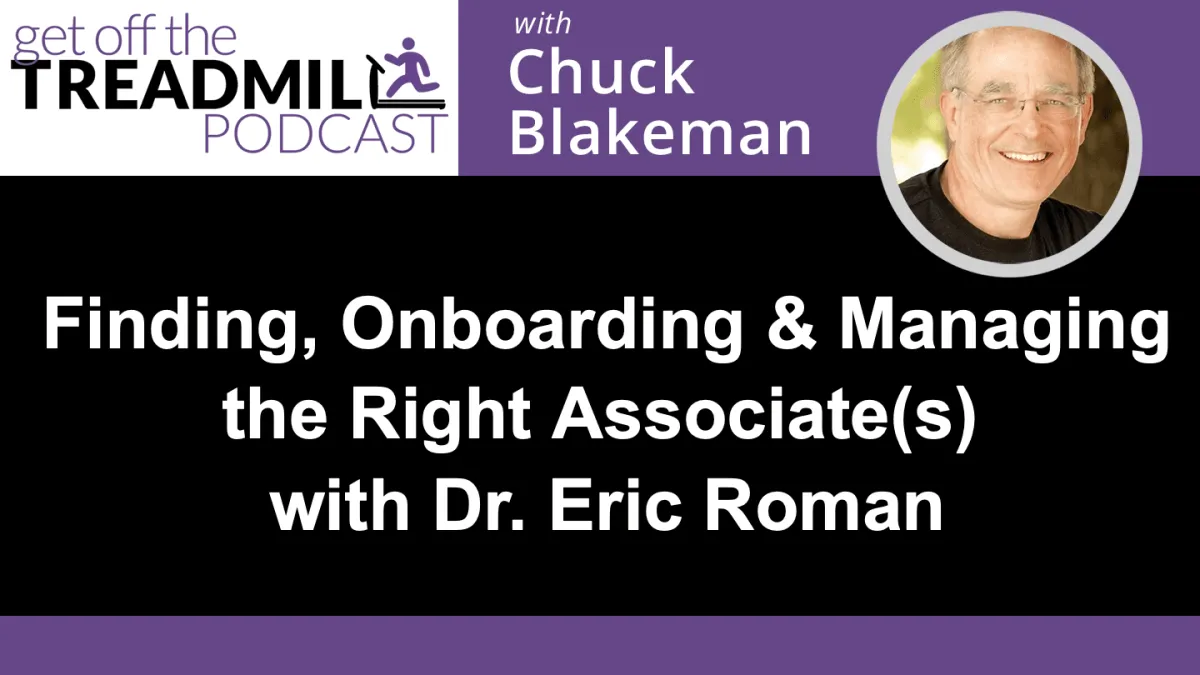

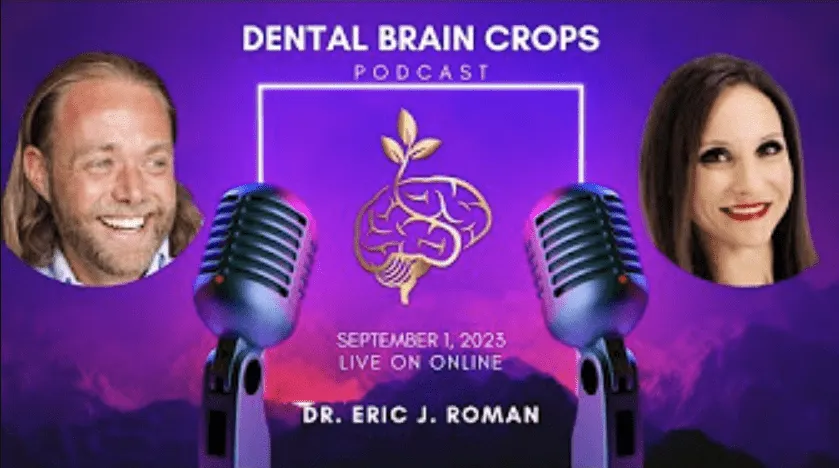

Podcast Appearances

Get Off The Treadmill

Today we are talking to Dr. Eric Roman abour finding, onboarding and managing right associate(s) for your practice(s).

Dental Brain Crops

Chelsea Myers and Dr. Eric J. Roman (https://drericjroman.com/) delve into empowering strategies for achieving success in both business and life.

The Macro Perspective

The Macro Perspective interviews Dr. Eric J. Roman.